This is where the Way Forward budget tool comes handy as it encourages you to take a longer-term view of your money and also, understand the monthly cost to an infrequent expense. This is when you might be hit with an ‘unexpected expense’ as you didn’t save up for the expense before it was due. For example, if you get paid monthly, you might budget for the month ahead but forget to consider the big bills that come through less frequently. This can leave them vulnerable to financial hardship. Many people have a short-term view when it comes to their finances and live paycheck to paycheck. If your provider won’t offer a better deal, do your research to establish if a competitor might. Contacting your lenders and service providers to negotiate a better deal is a guaranteed trick to save money. Explore discounts with lenders and service providers once a year.

Budget planner calculator free free#

Australia is blessed with countless options to enjoy our free time without breaking the bank – from camping to museums, galleries, city festivals, markets, hiking, swimming, beaches and so on. You don’t need to stop enjoying life as long as you’re being smart and savvy! For example, we often consider a holiday as a big investment but many things don’t cost as much as you think. Sometimes it’s too easy to dip into your savings account – consider opening a savings account with another bank so you’re less likely to use the funds.

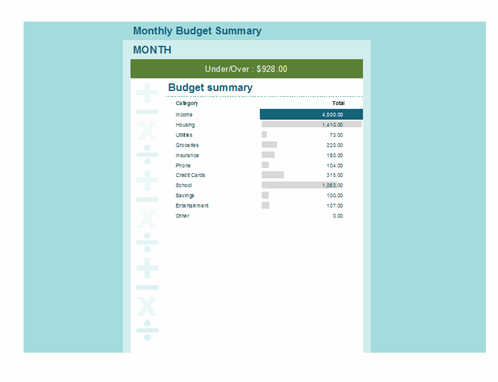

It will be easier to stick to a budget or a savings plan if you have a long-term goal in mind. Asking for assistance early on is likely to present more opportunities before financial problems begin to escalate. Whilst you may be able to manage changes to your income in the short-term by using savings or more credit, the circumstance can quickly deteriorate. This might seem obvious but can present a challenge due to changes in personal circumstances such as job loss. Make sure your income is more than your expenses.This budget planner is intended only as a helpful guide by assisting you in understanding your personal financial position.įor inspiration, our team of hardship advocates have prepared some of their top tips and mistakes to avoid when budgeting. Once completed, you can submit your details below to receive a copy of your personal budget for your records via email.įor additional information, tips and more, see below for our FAQ on budgeting. As you enter your details, it will be automatically saved and you can change the time period as needed ( weekly, fortnightly, monthly etc )Ĭlear your data by clicking reset at the bottom. Note if you clear your browser cache or history, you will reset the budget planner and lose the information you’ve inputted.

Use this personal budget planner on one device to build a comprehensive overview of your household budget. Using it is simple – just enter your income and expenses to find out where you are spending your money and how much money you have left to save or help repay your debts. Our interactive free budget planner tool helps you understand your current financial situation. Being across your household budget is an important part of staying on top of your finances.

0 kommentar(er)

0 kommentar(er)